Property Tax & Utility Increase Calculator

Introduction

Welcome to VoteNoFranklin.com! This page is dedicated to helping you understand the potential financial impact of the upcoming property tax override vote on June 11th. We have developed a calculator to estimate the increase in your real estate tax and utilities. Follow the instructions below to use the calculator and get a clear picture of what the override means for you.

Calculator Overview

Our calculator is designed to provide transparency regarding the potential increase in your property tax AND utilities. It combines the estimated tax impact of the override with the expected increase in utilities such as water and sewer rates. You only need to input information into four green cells to get your results.

How to Use the Calculator

Accessing the Calculator

Click the Property Tax & Utitlity Calculator to open the Google Sheets calculator.

Entering Your Information

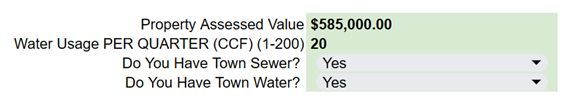

Step 1: Locate the four green cells where you will input your data.

Step 2: Enter the following details:

- Property’s Assessed Value: This is the value assigned to your property by the town for tax purposes. You can see the amount on your most recent tax bill or call the Town of Franklin’s Treasury department at (508) 520-4950.

- Water Usage per Quarter: Input your quarterly water usage in CCF (hundred cubic feet) from your most recent Water/Sewer/Trash bill.

- If you have town sewer select Yes from the drop down to the first question. If not, select No from the drop down. Follow the same steps for town water.

Understanding the Results

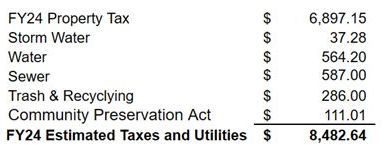

Based on the information you provide; the calculator will display the

- Estimated Current FY2024 Tax and Utilities Expense: Estimated total FY24 real estate taxes and utilities expense.

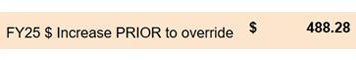

- FY25 $ Increase PRIOR to override: Estimated $ increase PRIOR to an override based on real estate taxes and utilities compared to what you paid in FY24. This estimated increase is expected to happen whether the override passes or not. See more details below.

- FY25 $ Increase from OVERRIDE: Estimated $ increase in your real estate taxes solely attributable to the override, if it passes.

- Estimated Annual Taxes AND Utilities FY25 W/ Override: Estimated annual real estate taxes and utilities expense for FY25 assuming the override passes.

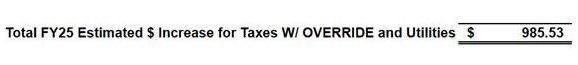

- Total FY25 Estimated $ Increase for Taxes W/ OVERRIDE and Utilities: Estimated $ increase for real estate taxes, with the override, and utilities expense for FY25 compared to FY24.

- Details on FY25 $ Increase PRIOR TO Override: This is a more detailed breakdown of the $ increase PRIOR to an override based on real estate taxes and utilities compared to what you paid in FY24. This is seen in the line item above as $488.28. You’ll notice additional details on the right-hand side for each line item. Several increases are still unknown. We are doing our best to understand the $ increases citizens may face.